Dallas has become one of the most active private aviation markets in the United States. What was once viewed primarily as a regional business center has evolved into a core hub for charter operators, corporate flight departments, and high-frequency executive travelers. This shift is supported by measurable traffic growth, expanding airport infrastructure, and sustained corporate travel demand.

For travelers evaluating charter options in Texas, understanding why Dallas performs so strongly helps clarify aircraft availability, airport access, operational flexibility, and pricing behavior. The combination of market demand, geographic positioning, and aviation infrastructure continues to reinforce Dallas’s role in the U.S. private aviation landscape.

Texas business aviation growth puts Dallas at the center

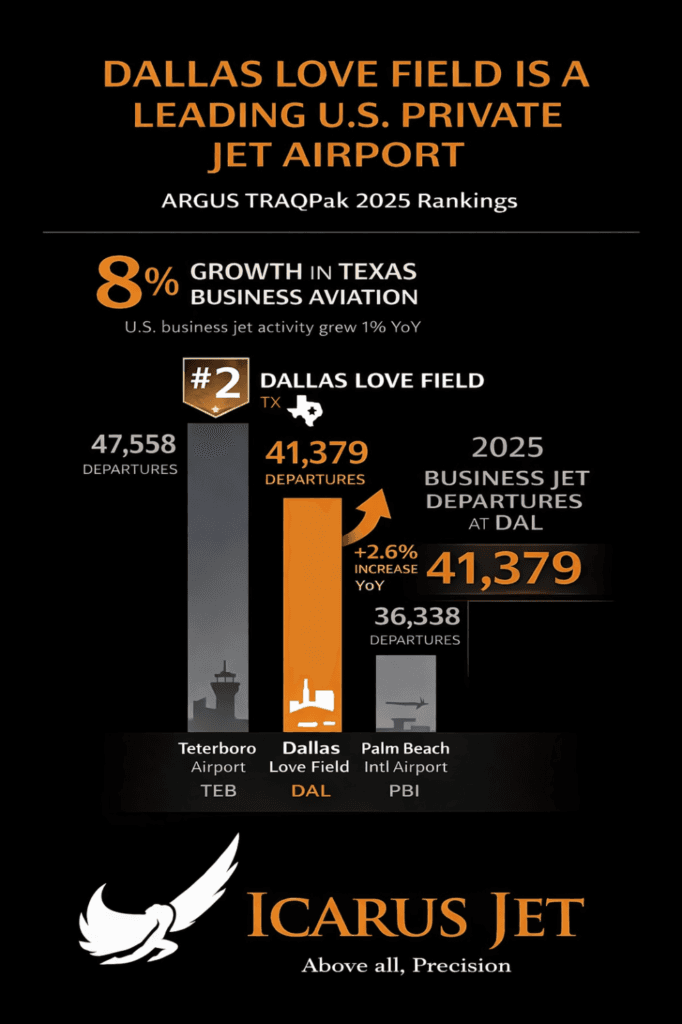

Recent WINGX tracking shows that while North American business jet activity grew by just 1 percent year over year in early 2026, Texas outperformed significantly with 8 percent growth. Florida followed with 4 percent growth, while California recorded a 2 percent decline. On a rolling four-week basis, Texas remained 3 percent ahead of the same period last year.

Dallas plays a central role in this performance. The Dallas-Fort Worth metroplex hosts one of the highest concentrations of corporate headquarters in the country, generating steady year-round travel demand from sectors such as energy, finance, healthcare, logistics, and technology. Unlike leisure-focused charter markets that experience pronounced seasonal swings, Dallas benefits from consistent business travel patterns that sustain aircraft utilization throughout the calendar year.

For charter clients, this stability supports deeper aircraft availability and a stronger local operator ecosystem. It also reduces exposure to short-term market volatility that can affect smaller or more seasonal aviation hubs.

Dallas Love Field rises to the second busiest private jet airport in the U.S.

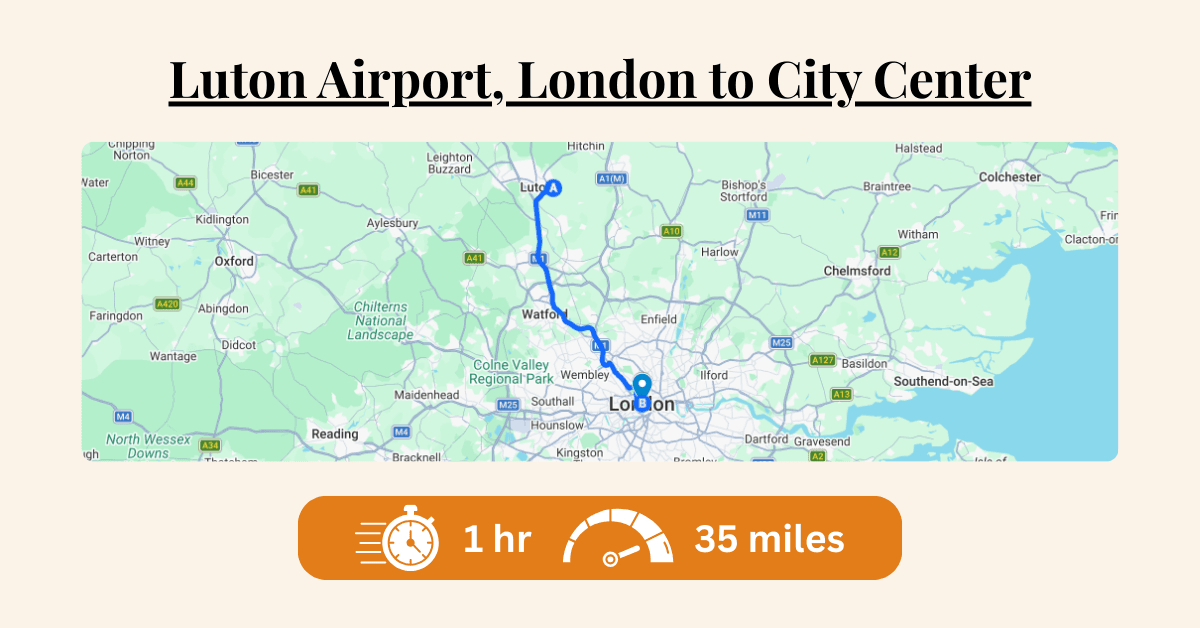

According to ARGUS TRAQPak rankings, Dallas Love Field moved from third to second place nationwide among U.S. private jet airports in 2025. The airport recorded 41,379 business jet departures, representing 2.6 percent year-over-year growth.

This places Dallas behind only Teterboro Airport, which continues to serve as the primary business aviation gateway for the New York metropolitan area. Love Field’s rise reflects not only increased traffic volume but also Dallas’s expanding role as a base for charter fleets and corporate aircraft.

From a traveler perspective, high departure volumes typically indicate stronger aircraft availability, broader operator competition, and more developed FBO infrastructure. Love Field’s location near downtown Dallas further strengthens its appeal by combining efficient ground access with a business aviation-focused operating environment.

Texas places four airports in the national Top 25

Dallas’s performance is part of a broader statewide trend. In the same ARGUS TRAQPak ranking, Texas placed four airports among the Top 25 busiest private jet airports in the United States. Alongside Dallas Love Field, these include William P. Hobby Airport, Austin-Bergstrom International Airport, and San Antonio International Airport.

This distributed footprint strengthens the Texas charter ecosystem as a whole. Aircraft repositioning between major Texas cities can be executed efficiently, improving availability in Dallas and reducing empty-leg flight time. For charter clients, this often translates into better scheduling flexibility and improved access to multiple aircraft categories without relying solely on out-of-state positioning.

Why Dallas works as a private aviation base

Several structural factors explain why Dallas continues to attract strong private aviation demand.

Dallas’s central geographic location allows efficient nonstop access to both U.S. coasts, Mexico, and much of the Caribbean. For long-range aircraft, the region also serves as a practical departure point for transatlantic missions, supporting efficient routing and strong aircraft utilization.

Corporate density remains another defining factor. North Texas hosts thousands of headquarters and regional offices, generating consistent executive travel demand that is not tied to tourism cycles. This stability supports predictable charter demand and long-term fleet basing decisions by operators.

Dallas also benefits from scalable airport infrastructure. Rather than relying on a single business aviation airport, the metroplex offers multiple specialized facilities that distribute traffic volumes and provide operational redundancy during peak travel periods.

Key private jet airports serving Dallas

Dallas charter traffic is supported by several airports, each serving different mission profiles and operational requirements.

Addison Airport is one of the busiest general aviation airports in the country and is widely used by corporate flight departments. With no commercial airline traffic, Addison offers a business-focused operating environment, strong hangar capacity, and a high concentration of based private aircraft.

Dallas Executive Airport serves the southern portion of the metroplex and provides a less congested alternative for charter operations. It is frequently used by turboprops and light to midsize jets and offers efficient access to southern business districts.

Fort Worth Alliance Airport supports large-cabin aircraft and international charter operations. With long runway capacity and integrated logistics infrastructure, Alliance is well suited for ultra-long-range business jets and high-capacity charter movements.

Dallas/Fort Worth International Airport, while primarily a commercial hub, continues to handle substantial corporate and charter traffic. Its on-site customs facilities make it practical for international arrivals, although higher airline traffic levels can increase ground movement times.

Aircraft availability and charter flexibility

Dallas benefits from one of the largest concentrations of based business aircraft in the central United States. This includes turboprops, light jets, super-midsize aircraft, and ultra-long-range models. High aircraft density improves same-day charter availability and reduces reliance on long repositioning flights, which can directly affect scheduling efficiency and trip economics.

The scale of the Dallas market also supports group charter operations. For corporate offsites, sports teams, production crews, and large event travel, operators can source high-capacity business jets or coordinate multiple aircraft under a single charter program. This capability becomes especially relevant during periods of elevated demand, when commercial airline capacity may be constrained or operationally inflexible.

For travelers, this depth of supply supports broader aircraft selection, more flexible departure windows, and improved reliability during peak travel periods. It also enables more efficient planning for complex itineraries involving multiple domestic or international destinations.

Dallas as a major event destination

Dallas is not only a corporate aviation hub but also a major destination for large-scale international events. The city will host matches during the FIFA World Cup 2026, an event expected to generate a substantial increase in private aviation traffic across North Texas airports.

During global sporting events, charter demand extends beyond individual travelers. Corporate sponsors, broadcast media teams, tournament officials, and hospitality partners often rely on coordinated group charter movements to transport larger passenger volumes on tight schedules. This can involve high-capacity business jets, multi-aircraft charter programs, or dedicated shuttle-style operations between host cities.

These demand surges place additional pressure on aircraft availability and crew scheduling. As utilization rates rise, pricing becomes more dynamic and lead times become more critical. Travelers planning event-related flights, particularly those requiring group transport or multi-aircraft coordination, should plan well in advance to avoid operational constraints.

What Dallas’s growth means for charter clients

Dallas’s continued rise in national airport rankings and Texas’s leadership in business aviation growth reinforce the city’s long-term position as a private aviation hub.

As private jet charter demand continues to grow across Dallas and Texas, partnering with experienced local providers like Icarus Jet offers practical advantages in scheduling, aircraft sourcing, and regional operational knowledge.

FAQs

How quickly can I book a private jet charter in Dallas?

Same-day bookings are often possible due to the high number of based aircraft. Availability depends on aircraft category and current demand levels.

Which Dallas airport is best for private jet arrivals?

The best option depends on your destination. Love Field is popular for downtown access, Addison is favored for corporate travel, and Alliance is preferred for large-cabin and long-range aircraft.

Is Dallas suitable for international private jet flights?

Yes. Dallas supports international arrivals and departures through airports with customs access and long-runway infrastructure capable of handling long-range business jets.

Does charter pricing in Dallas tend to be competitive?

Dallas benefits from strong aircraft availability, which can help stabilize pricing. Rates still vary depending on aircraft type, seasonality, and major event demand.

How will the 2026 World Cup impact private jet traffic in Dallas?

Major international events typically increase charter demand significantly. Travelers should expect tighter availability and higher utilization rates and should plan bookings well in advance.